- WHO FILES A 1065 TAX RETURN MANUAL

- WHO FILES A 1065 TAX RETURN FULL

- WHO FILES A 1065 TAX RETURN PRO

- WHO FILES A 1065 TAX RETURN CODE

The CCA then reviewed the criteria that must be established in order for Rev. 84-35.” These partnerships can, however, attempt to prove “reasonable cause” based upon some other factors, taking all of the relevant facts and circumstances into consideration.

WHO FILES A 1065 TAX RETURN PRO

84-35 and reasoned that “partnerships having a trust or corporation as a partner, tier partnerships, and partnerships where each partner's interest in the capital and profits are not owned in the same proportion, or where all items or income, deductions, and credits are not allocated in proportion to the pro rata interest, do not come within the exception of section 6231(a)(1)(B) and, as such, are not covered by Rev. 84-35 was drafted, this definition also required that “each partner’s share of each partnership item is the same as his share of every other item.” Section 6031 (the provision requiring partnerships to file a return) is found in subchapter A of chapter 61 and § 6698 (the provision imposing the penalty for not filing) is found in subchapter B of chapter 68. IRC § 6231(a)(1)(B) provides that for purposes of subchapter C of chapter 63 (which sets forth TEFRA audit procedures), the term “partnership” shall not include "any partnership having 10 or fewer partners each of whom is an individual (other than a nonresident alien), a C corporation, or an estate of a deceased partner.” At the time Rev.

WHO FILES A 1065 TAX RETURN CODE

states:Ī domestic partnership composed of 10 or fewer partners and coming within the exception outlined in section 6231(a)(1)(B) of the Code will be considered to have met the reasonable cause test and will not be subject to the penalty imposed by section 6698 for the failure to file a complete or timely partnership return, provided that the partnership, or any of the partners, establishes, if so required by the Internal Revenue Service, that all partners have fully reported their shares of the income, deductions, and credits of the partnership on their timely filed income tax returns. 84-35 to provide guidance on when partnerships with 10 or fewer partners would not be subject to the § 6698 penalty under this reasonable cause provision.

WHO FILES A 1065 TAX RETURN FULL

Although these partnerships may technically be required to file partnership returns, the Committee believes that full reporting of the partnership income and deductions by each partner is adequate and that it is reasonable not to file a partnership return in this instance. The Committee understands that small partnerships (those with 10 or fewer partners) often do not file partnership returns, but rather each partner files a detailed statement of his share of partnership income and deductions with his own return. The legislative history for § 6698 suggests that lawmakers intended this “reasonable cause” exception to protect small partnerships that did not file a partnership return: While there is no statutory exception to the § 6031(a) filing requirement for any partnership (regardless of size), the CCA explains that the § 6698 penalty may be avoided if it is shown that the failure to file a complete or timely return was due to “reasonable cause.” In 2017, these penalties are $200 per month per partner (for a period up to 12 months). The CCA began with the proposition that IRC § 6031(a) requires partnerships to file partnership returns and that when they don’t, they are generally subject to an IRC § 6698 penalty. The taxpayer seeking the advice acknowledged that “a small partnership is not relieved of the filing requirement,” but sought confirmation for the contention that they have “almost automatic reasonable cause relief for the failure to file a partnership return.” With this assertion, the CCA did not concur.

It also raises the question of how this provision will be applied in 2018, after new partnership audit rules are implemented. Yet, the advice very clearly sets forth the IRS position on this matter, which is very important to many agricultural partnerships.

WHO FILES A 1065 TAX RETURN MANUAL

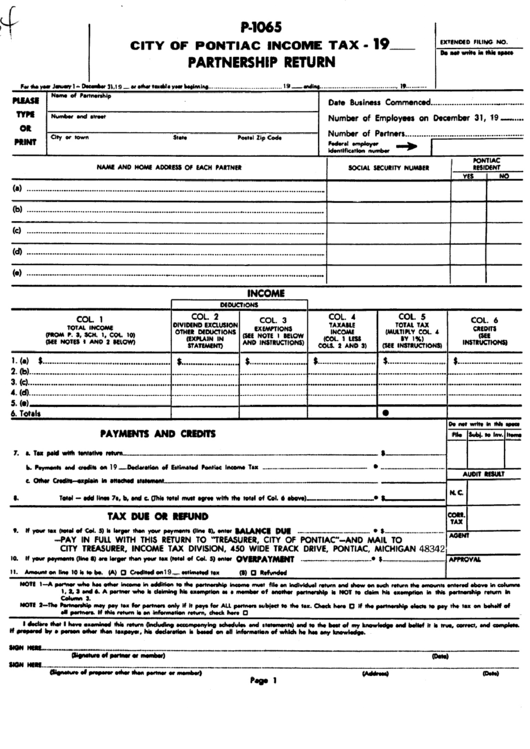

United States, and Internal Revenue Manual procedures detailing the requirements for applying Rev. The conclusion of the CCA 201733013 was not a surprise, especially in light of the 2015 case of Battle Flat, LLC v. Return of Partnership Income, because of Rev. IRS’ Office of Chief Counsel recently weighed in on an important question for small partnerships: Are they automatically exempted from the requirement of filing a Form 1065, U.S.

0 kommentar(er)

0 kommentar(er)